Dehradun, Uttarakhand: For more than a year, engineering graduate Kundan Kumar from Saran district of Bihar has been trying to unsubscribe from an insurance policy he did not choose to buy in the first place.

Without his consent, Kumar’s bank deducted money from his account and enrolled him in the union government’s life insurance scheme—Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

Days after his account was debited on 29 December 2022, upset that the bank, supposed to safeguard his money, took it without permission, Kumar, 26, sought a copy of his insurance application form from the bank under the Right to Information (RTI) Act, 2005.

On 2 February 2023, his bank, State Bank of India (SBI), replied, “Application form not found for the aforesaid insurance.”

The bank has not granted him a refund for this unsolicited insurance. He told Article 14 in an interview that he was still looking for a way “to get out of this dirty system”.

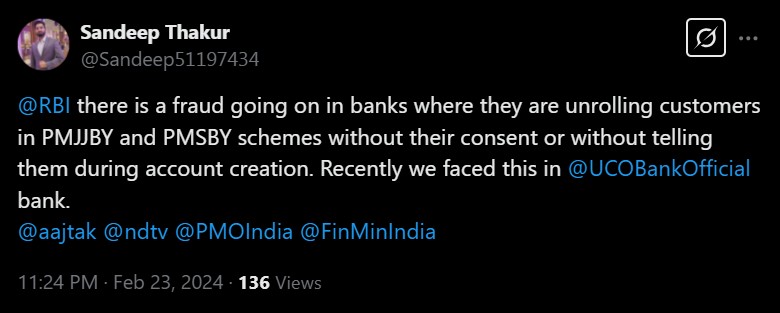

Like him, many across the country have protested unauthorised debits from their bank accounts for the government's insurance schemes.

Apart from life insurance, banks have also been enrolling customers without consent in the accident insurance scheme, called Pradhan Mantri Suraksha Bima Yojana (PMSBY). These complaints also extend to the centre’s micro-pension scheme, called Atal Pension Yojana (APY).

Like Kumar got enrolled in PMJJBY without consent, his mother was enrolled in the APY without consent, he said.

While the PMJJBY premium is Rs 436 a year, PMSBY costs Rs 20 a year. Once a customer is subscribed to these schemes, the fees are deducted automatically from his/her account annually.

The PMJJBY provides a cover of Rs 200,000 to a policyholder’s nominee in the event of death due to any reason. The PMSBY provides Rs 200,000 in case of death due to an accident and Rs 100,000 in case of a severe accident injury. The APY offers a monthly pension of up to Rs 5,000 after the age of 60. The monthly fee depends on the pension plan selected.

Often, those enrolled in insurance schemes without consent are not aware that they are paying a premium for an insurance cover. This prevents family members from availing the schemes’ benefits, rendering their premium payments—unauthorised to begin with—futile.

Bank employees tend to enter fabricated data while activating insurance schemes without the policyholder’s/account holder’s consent, said bank employees.

Policy certificates of such customers, accessed by this reporter, showed bogus nominees. This also restricts policyholders’ families from availing the benefits of the schemes.

Prime Minister Narendra Modi launched these low-cost welfare schemes in May 2015 to provide financial security to the poor. From the beginning, banks faced allegations of enrolling customers in these schemes through fraudulent practices (here, here, here), purportedly because of government pressure.

In previous reports for Article 14 and The Wire, this reporter has described various ploys through which banks’ branches and field staff force these schemes upon their customers.

New evidence reveals that this malpractice has since been institutionalised, with regional, zonal and even head offices executing these frauds and forcing branches to conceal.

Huge Targets, Quick Fixes

The quickest albeit illegal way to enrol a high number of customers appears to be what is called “bulk activation”, where banks can upload and approve many customers’ details into the insurance-activation portal all at once using a spreadsheet or another bulk upload file.

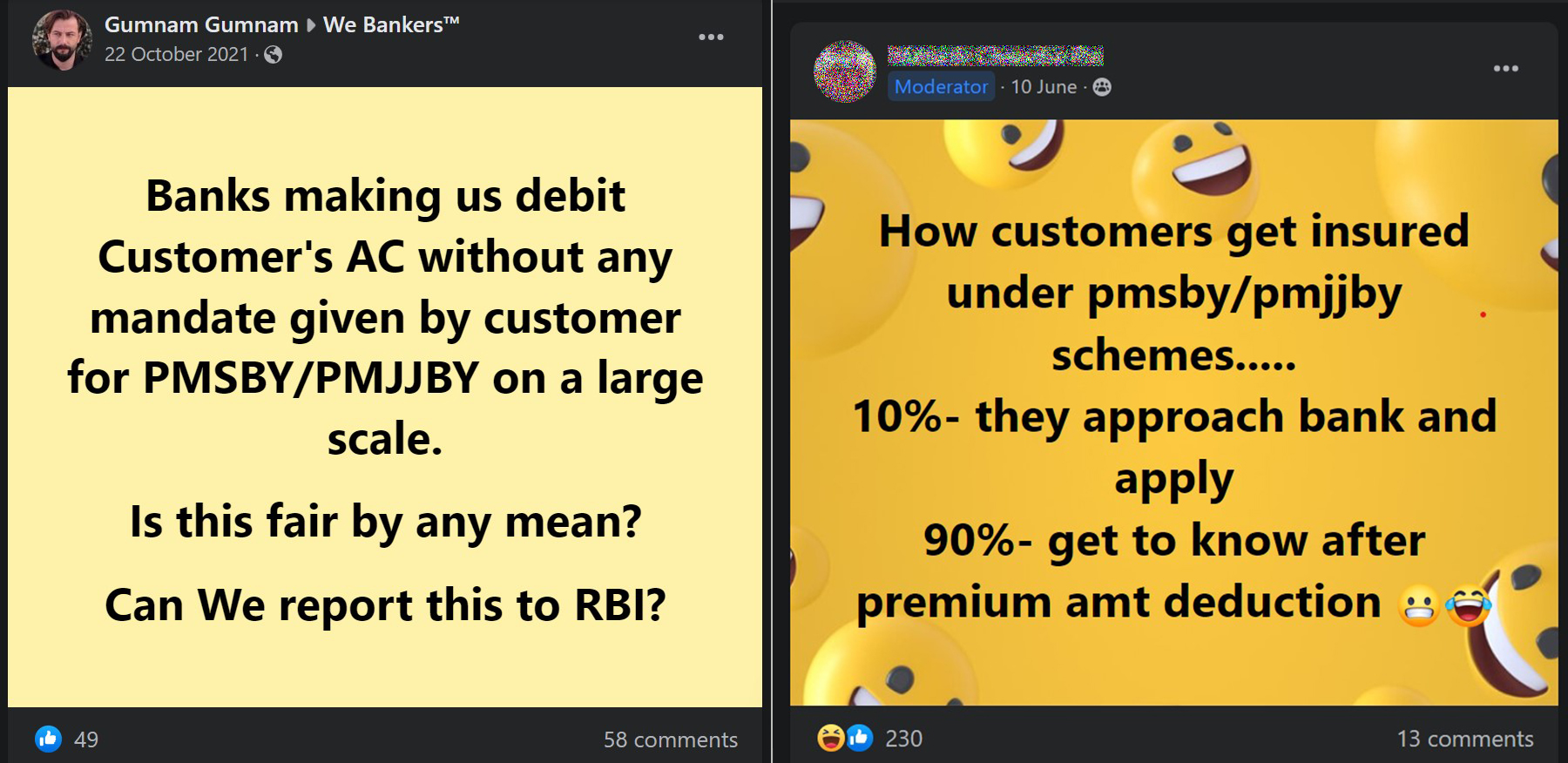

No matter how steep the targets, they can be met with just a few clicks as long as the bank does not mind enrolling customers without their knowledge. Bank employees’ posts on X illustrate that this mode of enrolling customers is a matter of fact at banks.

In August 2023, an officers’ union of government-run UCO Bank sent a letter to its managing director & CEO, alleging that account holders in Dehradun were illegally enrolled in these government schemes from the back-end by the head office. Article 14 has a copy of the letter.

It says that in July-end, the zonal office in Dehradun sent the branches a list of accounts eligible for PMJJBY and PMSBY and asked the branches to activate the schemes in all of them, the letter said. Many branch managers refused to do so without customers’ consent, only for the head office to do this from the back-end.

The union’s letter said customer complaints began to trickle in, and branch managers requested their zonal office to issue refunds, but the zonal office instead instructed them to collect and backdate enrolment forms.

An employee of government-owned Canara Bank told this reporter that a similar story unfolded in Rajasthan last June. He said that regional offices sent branches lists of their customers eligible for PMJJBY.

Some branches enrolled customers without consent, some refused. The employee alleged that in the case of branches that refused, customers found themselves enrolled for the insurance from the back-end by their respective regional office.

This employee shared screenshots of the bank’s content management system, showing that PMJJBY was activated on customers’ accounts in bulk by an assistant general manager posted in a regional office. Article 14 has sent queries by email to this officer and is awaiting a response.

This reporter’s previous report on illegal enrolment of customers in these schemes was based on similar evidence of bulk activation in Canara Bank’s West Bengal unit.

One SBI employee from the bank’s Delhi circle shared with Article 14 screenshots of the bank’s de facto official WhatsApp group in October 2023. (Banks do not recognise WhatsApp as an official mode of communication, but liaisoning between regional/zonal offices and branches does take place on WhatsApp groups.)

The WhatsApp screenshots sent by the SBI employee showed bank employees being given instructions on how to initiate bulk enrolment of customers in PMSBY. This employee also shared screenshots of the bulk upload files.

“Today is login day for PMSBY in SBI Delhi circle. A huge number of fake PMSBY registrations will be done today. Excel data also placed by module office,” the employee told this reporter via WhatsApp.

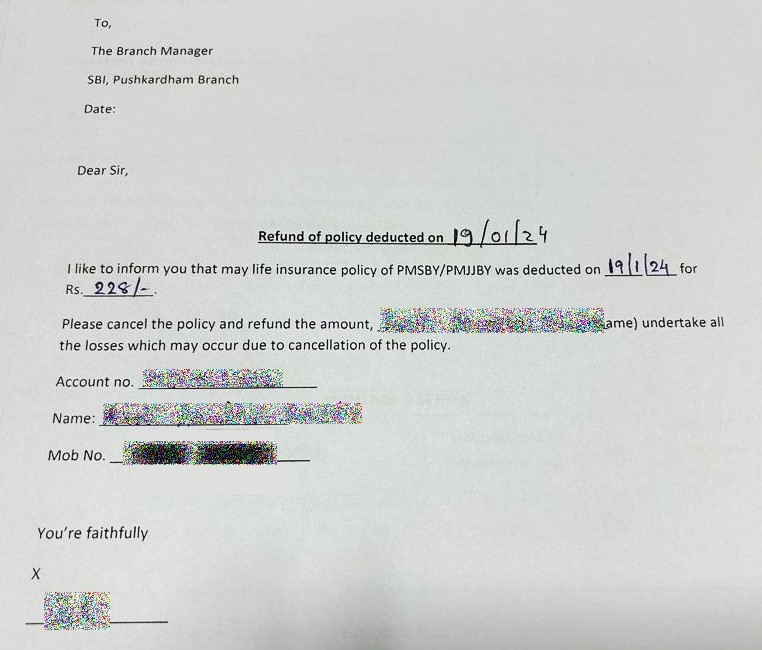

A Gujarat resident told this reporter that his wife’s SBI account was auto-debited for PMJJBY on 19 January 2024. He said that when she went to her branch to seek an explanation, the branch told her that many accounts were debited because of a technical error, and now the bank was offering a full refund. To refund the money, the bank asked her to fill a form.

This customer’s husband told this reporter that he spoke with the branch manager, who apologetically said that he had received a list of accounts from his regional office and had no option but to debit them to save his job.

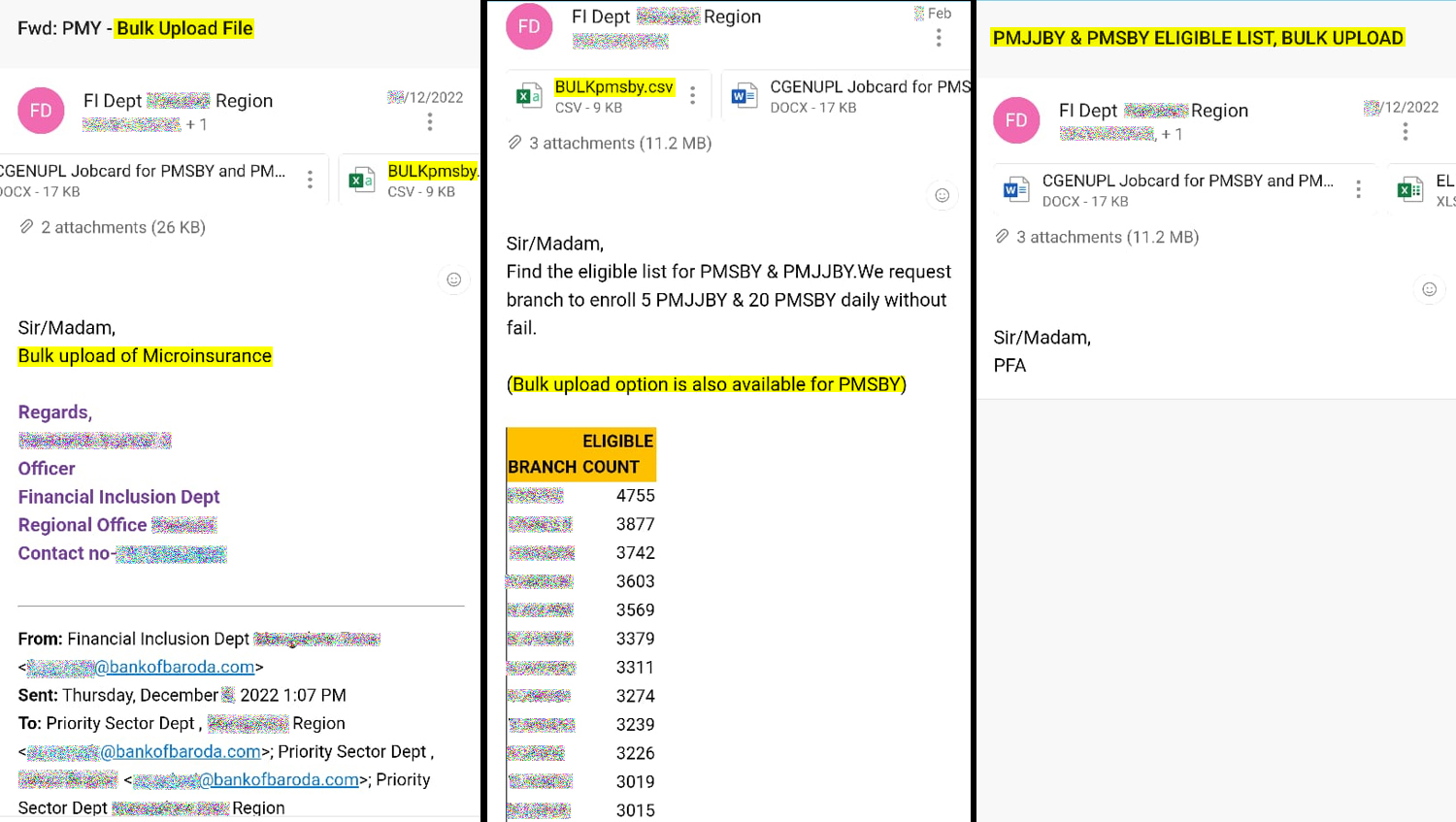

SBI is India’s largest public sector bank. The second largest government bank, Bank of Baroda, also uses bulk activation to meet enrolment targets without customers’ consent.

One Bank of Baroda employee from Karnataka shared screenshots of emails from December 2022 and February 2023, bearing details of eligible customers and instructing branches to enrol them in PMJJBY and PMSBY via bulk activation.

This employee said he had to do bulk enrolment of customers in PMSBY without their consent when his deputy regional manager asked him to do so and provided him with the list.

In response to Article 14’s queries about enrolling customers without their consent, UCO Bank’s assistant general manager of the financial inclusion department, Joydeep Nandy, sent the following reply: “In our communication to our zonal offices, we clearly mentioned that the customers should be contacted and persuaded to get enrolled under PMJJBY and PMSBY. We also mentioned that due procedure of PMJJBY and PMSBY enrolments like obtaining consent forms, nominee details etc. should be followed by branches before enrolment of customers.”

Nandy said a bulk enrolment menu was especially devised.

Branches sometimes conduct camps and receive a large number of applications, leading to difficulties in entering individual applications into the system in a short span of time. “For ease of working, the bulk enrolment option was made available to help the branches and clear out the large number of pending applications,” Nandy said.

“In light of the above, we have not followed any unethical practice while enrolling customers under both the schemes.”

The bank’s customers have been stating otherwise.

Article 14 discussed these allegations with forensic accountant and certified fraud examiner Nikhil Parulkar, a co-founder of forensic advisory services firm Ocurisc Consulting.

He said the UCO Bank employee union’s letter, employees’ allegations and online complaints are material enough to warrant an internal/forensic investigation, which would entail checking with customers whether they were enrolled with or without their consent.

Parulkar said the first step would be to order an immediate stop to debiting customers’ accounts for the schemes. Then the bank’s internal audit team or the vigilance department should check with 10–15% of randomly selected customers whether they were enrolled with or without their consent.

Canara Bank, SBI and Bank of Baroda did not reply to Article 14’s questions about enrolling customers without their knowledge.

However, a January 2024 report in MoneyControl showed that the SBI was aware of the problem and had issued a letter in this regard, instructing branches to desist from “such unethical practices”.

Parulkar said the problem of debiting customers’ accounts without permission for one or the other schemes is a common ailment, called predatory sales practices in forensic audit parlance. He said such scenarios are prevalent in the banking sector, including private sector banks, but don’t get exposed until a whistleblower comes forth.

Canara Bank’s Cover-Up

Canara Bank underwent an audit in December 2023 after an article in The Economic Times highlighted online complaints about unauthorised debits for PMJJBY and PMSBY.

The bank’s employees’ grapevine was abuzz with news about this audit. Purportedly, the government asked the bank’s leadership to look into the allegations. Subsequently, branches were asked to examine customers’ application forms for these schemes. Since many customers were enrolled without consent via bulk activation, their forms did not exist.

An employee said his regional manager—the very official who had enrolled customers without permission in bulk—advised branch heads during a video conference to give a fake confirmation that the forms were all in place. The employee said his branch did just that. Eventually, its claim was accepted on face value and not cross-checked.

Article 14 has a copy of an email sent by a regional office of the bank to employees about the audit. Sent on 29 December 2023, it says: “All employees are advised to ensure that the consent forms in respect of PMJJBY and PMSBY enrolled accounts are obtained and placed on records. Inspection wing has given a timeline up to 30.12.2023 to ensure that the consent letter from customers has been obtained invariably and kept on record.”

Insurance regulations categorically state that customers be enrolled in any scheme only with prior and express consent in a prescribed format. However, it is a standard practice in banks to quietly enrol customers without their knowledge and seek applications later, if or when needed.

A former branch manager of Canara Bank posted in central India recounted that a couple of years ago, his regional office enrolled 50-odd customers of his branch in PMJJBY from the back-end, without consent. He said that to save himself from any trouble later on, he obtained application forms from most of the customers over the next few weeks.

For the aforesaid audit that followed The Economic Times report, Canara Bank employees were required to pull off a similar feat, in one day. About two weeks after the bank asked its employees over email to obtain consent forms, a bank officer told Article 14 via WhatsApp that the management was turning on the heat. “The application pressure is real. I feel like resigning [from] the job. What the heck! Someone from the back-end did something, now they are asking us to clean that mess. How am I going to get 4,000 forms!”

The employee later said she did not arrange for the forms as the pressure for the same vanished. Canara Bank did not reply to Article 14’s questions about this audit and the aforesaid email. Forensic auditor Parulkar said the email unambiguously pointed at wrongdoing.

“Wherever we have enrolled without asking, create a paper trail for that and place it on record. That is how this email has to be read,” he said, adding that this is a fraudulent practice tantamount to doctoring a document.

Pressure From The Top

For this pressure, bank employees do not blame their management as much as they blame the Department of Financial Services (DFS), which is in charge of key initiatives of the government concerning the banking and insurance sectors.

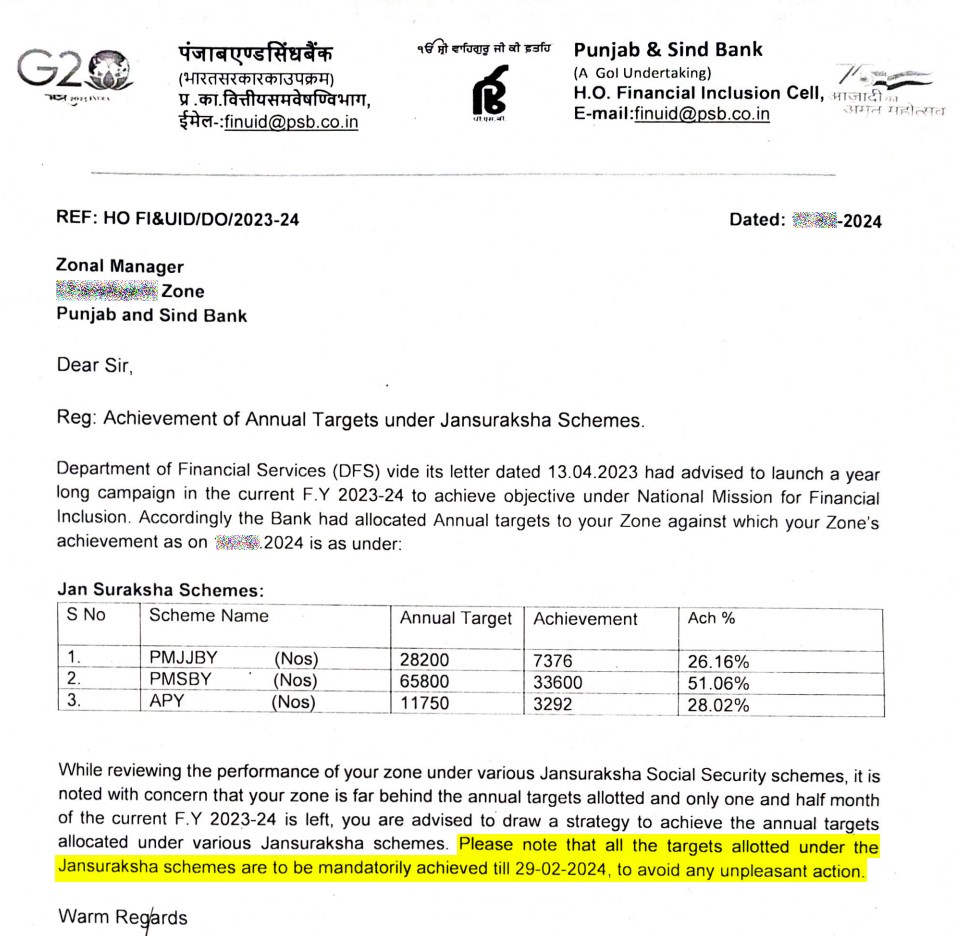

For PMJJBY, PMSBY, APY and other government schemes, the DFS gives enrolment targets to banks. Bank employees told Article 14 that top executives are berated by the DFS and threatened with consequences for failing to meet the targets.

A recent letter issued by government-run Punjab & Sind Bank to a zonal manager illustrates this top-down pressure. The letter cites the DFS’s order about these insurance and pension schemes, notes that the zonal manager’s area is lagging behind, and ends with a warning: the targets are to be “mandatorily achieved” to avoid “any unpleasant action”.

Article 14 also has audio-video clips of a performance review meeting of Union Bank of India’s Ayodhya region from November 2022. In the meeting, the bank’s regional head was rebuking branch managers for not meeting their enrolment targets for PMJJBY and PMSBY. “On December 1, MD & CEO has a meeting with the Department of Financial Services. Secondly, the [Union] Finance Minister will do the review herself,” the regional head is heard saying sternly.

Likewise, Article 14 has seen screenshots of bank employees’ WhatsApp groups wherein senior managers bring up the DFS’s name to push their staff to achieve enrolment targets. “As this is a DFS requirement, please drive maximum business today,” says one such message.

This pressure tactic is used not only on bank employees but also on business correspondents—independent service-providers who run banking kiosks or mini-branches in remote regions.

An SBI kiosk operator from rural Bihar told this reporter that his seniors have been ordering every day in online meetings to meet the targets assigned by the DFS.

He said seniors advise arm-twisting customers into signing up and also threaten kiosk operators with loss of pay. Article 14’s previous report explains how these dynamics lead to widespread fraud with rural customers. A report in Hindi daily Dainik Bhaskar on 17 March described how an SBI kiosk operator in rural Madhya Pradesh fraudulently enrolled customers in PMSBY and registered their dead fathers as nominees.

Article 14 sought comment from the DFS and the union finance ministry via email on 2 March. There was no reply. If there is a response, we will update this story.

Article 14 filed an RTI request with the department and sought a copy of its letters/circulars to banks regarding enrollment under PMJJBY, PMSBY and APY.

It refused the information on the grounds that: “The information sought is under deliberation with the concerned stakeholders. The information received or generated is in fiduciary capacity and is likely to affect and compromise the strategic and economic interests of the State. The disclosure of such information is likely to affect the decision-making of the authority.”

Employees of various government banks explained to Article 14 how the pressure for these schemes percolates from the management to ground-level staff and results in fraud. Requesting anonymity, a mid-level officer of a government bank recounted a first-hand experience from his stint in a regional office: high enrolment targets for PMJJBY and PMSBY were imposed upon managers, eight of whom fell short, so they were lambasted in a meeting and their salary docked for a couple of months.

“It’s our helplessness that we have to do this… [We] feel very guilty about what we have been doing to people,” a UCO Bank employee told Article 14 on the condition of anonymity.

He said he once discussed with his senior, an assistant general manager, his apprehensions about debiting customers’ accounts without consent. He said the official dismissed his concerns and told him, “Kya fark padta hai! Kuch nahi hoga. Sab upar se neeche tak government ka saath hai.” (How does it matter! Nothing will happen. From the top to the bottom, we have the government’s backing.”

To gauge the extent of fraudulent enrolments, this reporter created a poll in three Facebook groups of bank employees. One group was the bank union We Bankers, and the other two were private groups for employees of Punjab National Bank (PNB) and Canara Bank.

Of the 428 people who voted, more than 91% said that either they or their colleagues were under pressure from their seniors to enrol customers in PMJJBY and PMSBY by hook or by crook.

On Facebook as well as X (here, here, here), bank employees have been decrying the pressure and arm-twisting to enrol customers in these schemes without their knowledge.

Customers Hit Back

While the insurance schemes are low-cost and beneficial, unauthorised debits for the same have annoyed many.

X is awash with complaints of such customers, many of whom are students, unemployed youth and the poor, for whom every rupee matters. Some people have posted (here, here) that their account balance has gone into negative because of these unauthorised and unplanned deductions.

The scale of these unauthorised debits can be ascertained from the fact that YouTube videos (here, here, here) about how to exit these schemes garner lakhs of views and hundreds of angry comments from aggrieved bank customers.

A Canara Bank customer from Karnataka is suing the bank for debiting his account without consent for PMJJBY and PMSBY. In a case filed with Dharwad district consumer forum last July, Kiran M Goli sought Rs 5 lakh as damages for breach of fiduciary trust.

Goli told Article 14 over a phone call that the bank offered to settle the matter outside the court for Rs 1 lakh, an offer he rejected. He said he is pursuing the case not for money but for drawing the judiciary’s attention to this fraud.

He said he planned to file a petition in the Supreme Court and request a forensic audit into all banks’ enrolment modalities for PMJJBY and PMSBY.

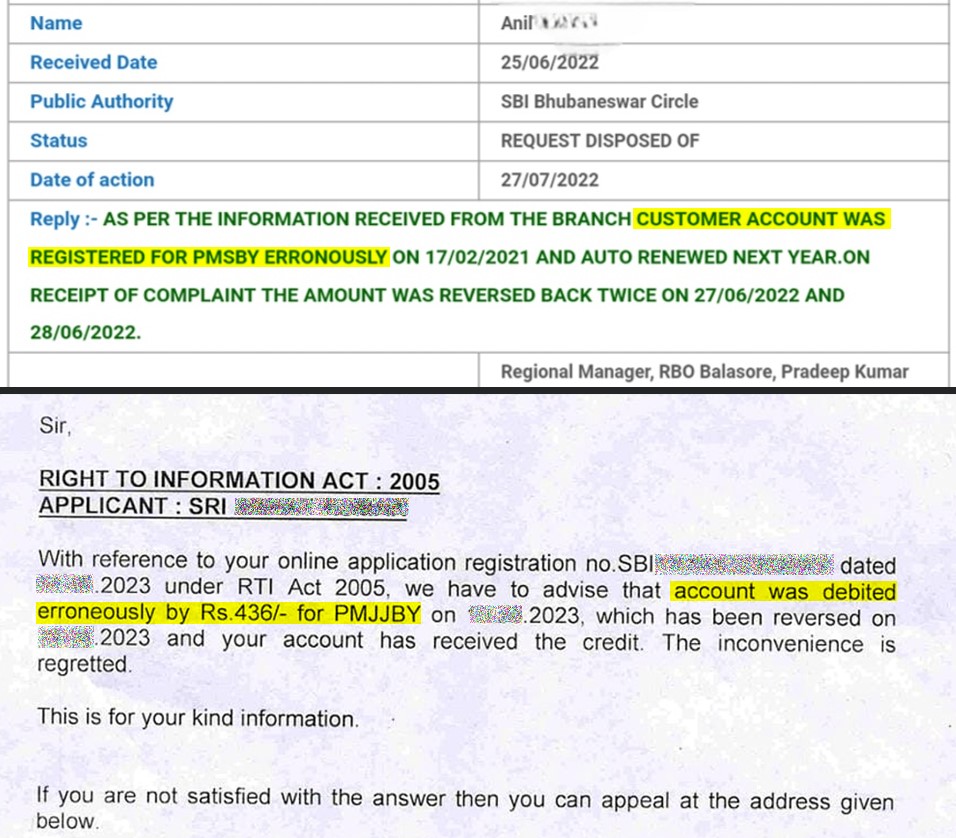

Goli said Canara Bank granted him a refund for unsolicited insurance. The bank reportedly told him it intended to debit somebody else’s account but his account was charged because of a technical error. The bank gave the same explanation to another customer from Rajasthan who had filed an RTI request in July 2023 to ask how his account got charged for these schemes. The bank’s RTI reply said, “Due to some technical error, your account was debited for some amount instead of the other account. The deduction was totally a technical error.”

On the same lines, SBI replied to an RTI query of a Bihar resident last June by saying that his account was debited for PMJJBY erroneously. This reporter knows of banks giving the same reply to other customers’ RTI requests as well.

Certified fraud examiner Parulkar said that with many frauds that do take place in banks, especially in recent times, it is observed that a cover-up can be pulled off by portraying the fraud as a “technical” error. He said banks generally try to get away on the grounds of technicality. He said that while the benefit of doubt must be extended to everyone under the principles of natural justice, banks tend to use this tenet as a shield to hide their malpractices.

“Somebody who understands the system, the investigation process/strategy and all these practices, will not accept it,” he said about the plausibility of a technical error driving unauthorised debits across banks and across the country.

When customers demand a refund, at times bank employees pay them from their own pocket to avoid hassles. A PNB customer from Punjab said her branch manager paid her in cash and made the entry manually in her passbook. Article 14 has seen the passbook entry.

Likewise, an SBI employee from rural Uttar Pradesh offered to give a refund to a student from his own pocket after the student filed an RTI request and sought his enrolment forms. This reporter has the call recording in which the bank employee can be heard requesting the student to accept the money and let go of the matter, or else the employee would be in the line of fire. The student refused to accept money from the employee and insisted that the bank refund him, a request that was ultimately accepted.

Bank employees told this reporter that the unrelenting pressure to add customers in these schemes has been taking a toll on them. Refusing to enrol customers through easy but illegal methods can earn the ire of seniors whereas a complaint of wrongful enrolment from a customer can be a blot on their record.

As of 26 April 2023, more than 16.19 crore people stood subscribed to PMJJBY and more than 34.18 crore stood subscribed to PMSBY. Bank employees contend that if a forensic audit is undertaken, most of these registrations will turn out to have been done without customers’ knowledge.

(Hemant Gairola is an independent journalist based in Dehradun.)

Get exclusive access to new databases, expert analyses, weekly newsletters, book excerpts and new ideas on democracy, law and society in India. Subscribe to Article 14.