Dehradun (Uttarakhand): At the 90th anniversary celebration of the Reserve Bank of India in Mumbai on 1 April 2024, Prime Minister Narendra Modi cited as a success story the eRupee, or the Central Bank Digital Currency, the Indian central bank’s alternative to cash, stored in and used through digital wallets.

Its supposed success story, however, was scripted through contentious means.

The pilot of the eRupee began in December 2022. Even until October 2023, it was witnessing only about 25,000 transactions a day on average. On 27 December, however, this number saw a 40-fold jump with more than 1 million transactions recorded.

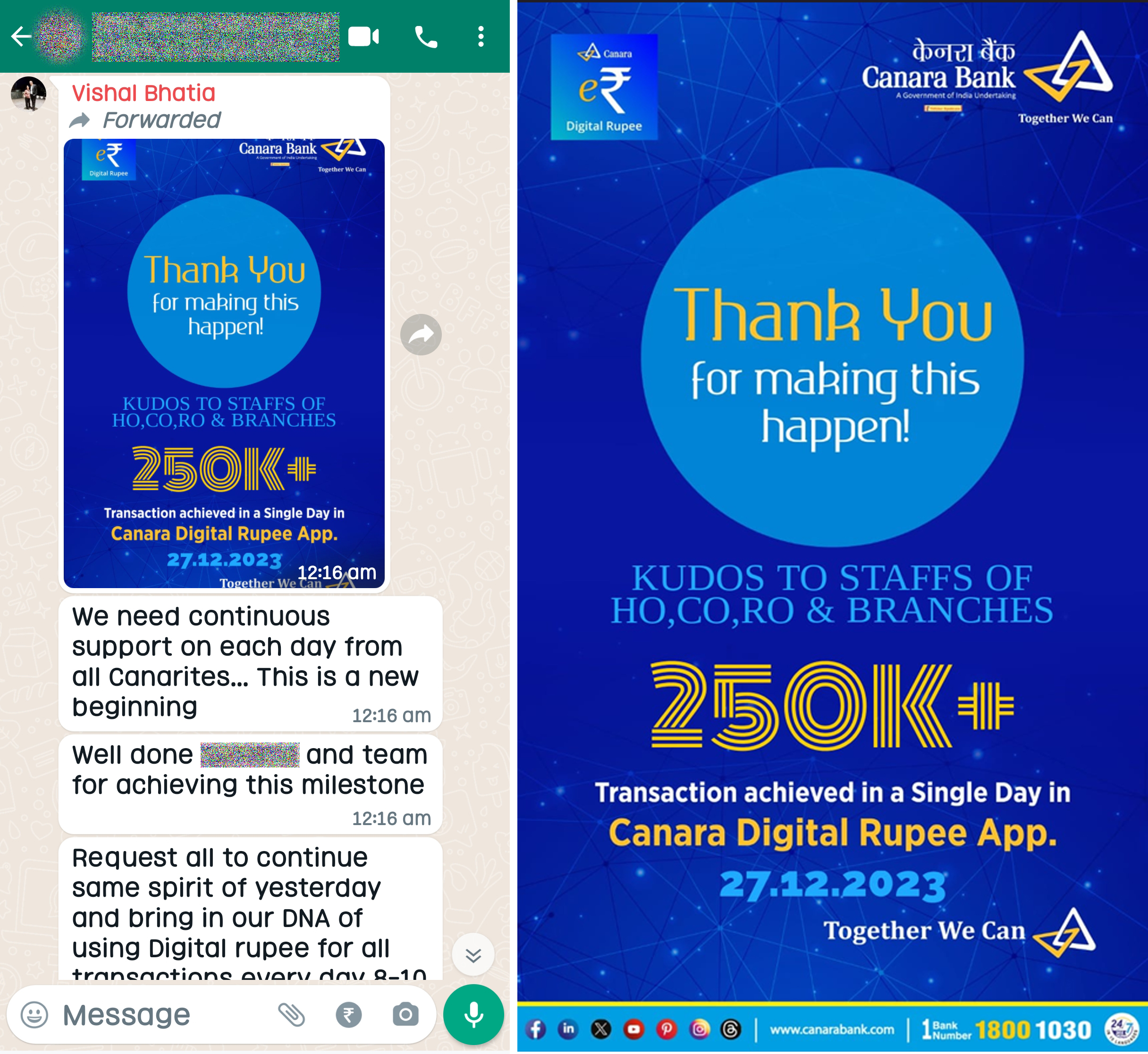

More than a quarter of these transactions came from Bengaluru-headquartered Canara Bank, in the form of bogus exchanges of money among the bank’s employees under incessant pressure from the management.

Five employees of the public sector bank confirmed this to Article 14, two of them with screenshots of their transactions on the Canara Digital Rupee app.

The screenshots showed multiple transactions, each of one eRupee, on 27 and 29 December, the two dates on which Canara Bank was attempting to register a high number of eRupee transactions.

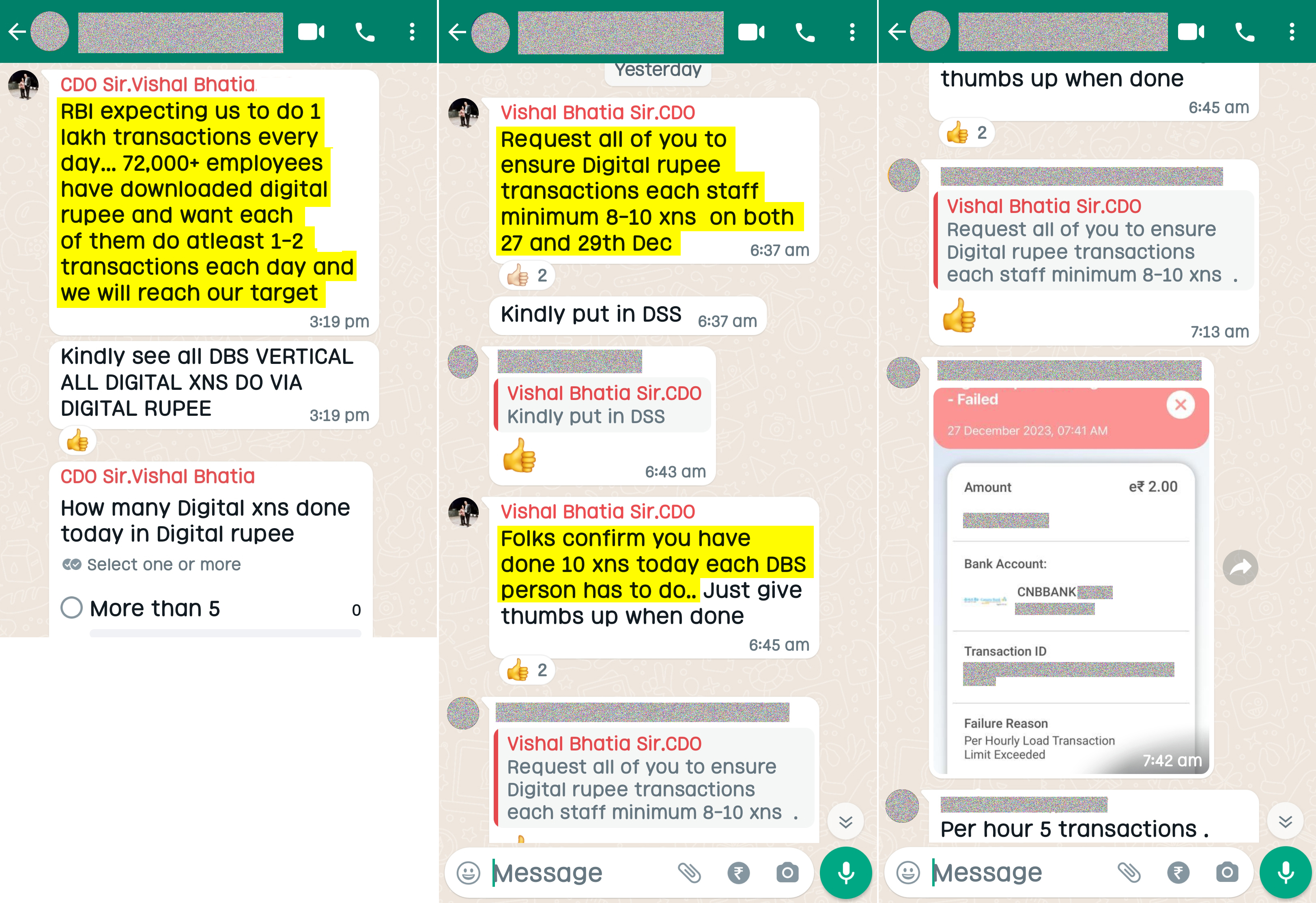

Another employee shared screenshots of the bank’s WhatsApp group in which the bank’s chief digital officer Vishal Bhatia repeatedly urged employees to do eight to 10 transactions each on 27 and 29 December. “Folks, confirm you have done 10 transactions today,” one message said. “Each person has to do (sic).”

The WhatsApp screenshots show that Bhatia kept tabs on the number of staff transactions made in each region nationwide. He started texting orders in this regard at 6:37 am on 27 December.

His other message said: “RBI expecting us to do 1 lakh transactions every day. 72,000+ employees have downloaded [Canara] digital rupee [app] and want each of them [to] do atleast 1–2 transactions each day and we will reach our target.” (Sic)

In the WhatsApp group, a senior executive shared a screenshot showing that his transaction of two eRupees failed because he had exceeded the hourly transaction limit, evidence of how the bank’s personnel were inflating transactions.

Canara Bank did not respond to Article 14’s questions sent in this regard via email on 13 May and a reminder on 10 June. Bhatia did not respond to questions sent via email on 11 June either.

This is one of several instances where banks in India, which serve as crucial conduits for government schemes, have found themselves under pressure to deliver impressive results.

This report is the first of a two-part investigation highlighting the prevalence of frauds in India’s banking system. The second part delves into the root causes of these systemic frauds—disempowerment of employees—and the outcome of intense work pressure to meet targets at any cost.

Whether government or RBI programmes or their own business metrics, evidence compiled by Article 14 indicates that some banks in India inflate figures related to achievements and suppress failures, using unethical means.

On multiple occasions, India’s banks have dished out falsified performance figures, ostensibly to satisfy the federal government. Bank employees Article 14 spoke to said it was part of their job to manipulate transactions to achieve targets.

This practice gives policymakers false data to work with and whitewashes failures, undermining the stability of financial systems, affecting everything from market confidence to the daily lives of citizens, said experts.

Neither the RBI nor the union ministry of finance responded to Article 14’s detailed questionnaire sent by email on 21 May and a reminder sent by email on 10 June.

‘100% Staff Activation’

To compel them to use the eRupee, employees said, the Canara Bank management also deposited a portion of employee allowances in the Canara Digital Rupee app on 27 and 29 December, a few days before their salaries were due to be credited.

All employees who had downloaded the Canara Digital Rupee app, in branches across India, found a part of their allowances deposited in it.

Thomson Reuters reported that apart from Canara Bank, this trick was also adopted by four other banks that are a part of the RBI’s eRupee pilot—HDFC Bank, Kotak Mahindra Bank, Axis Bank and IDFC First Bank. Without naming any bank, The Economic Times also reported the inauthentic nature of these eRupee transactions.

“The magic one million number was achieved by a combination of creativity and coercion,” The Economic Times noted. Many in the media amplified this ‘achievement’ of 1 million transactions, highlighted also by RBI Governor Shaktikanta Das in a letter to RBI staff on 29 December 2023.

Like Canara Bank, Bank of Baroda also urged its employees to use eRupee to bump up transactions. An employee from Gujarat sent Article 14 screenshots of his regional office’s WhatsApp group, in which an officer from the operations department on 20 March asked for “100% staff activation… All region staff are requested to initiate at least 2 transactions on daily basis” as per the orders of the bank’s chief general manager (digital group) and RBI initiative.

Within three minutes, the regional manager sent one eRupee to another employee and shared the screenshot of the receipt in the group to set an example for others. Bank of Baroda did not respond to Article 14’s request for comments despite a reminder.

Fraudulent Financial Inclusion

At the ‘RBI@90’ anniversary event, Modi also lauded the government of India’s financial inclusion programmes, including the Kisan Credit Card (KCC).

This programme provides collateral-free loans to farmers to help meet their crop-related expenses. Bank employees told Article 14 that pressure to increase beneficiaries of the scheme was so intense that they felt compelled to sanction loans even to those ineligible.

An employee of one of the largest government banks shared with Article 14 forged documents through which two KCC accounts were renewed in April 2024, just two of the many, he said, adding that without this forgery, all these accounts would become non-performing assets or NPAs, overdue advances or loans. Documents forged included deposit slips and withdrawal slips.

Bank employees have raised the issue on social media (here, here) and in letters to the management for several years.

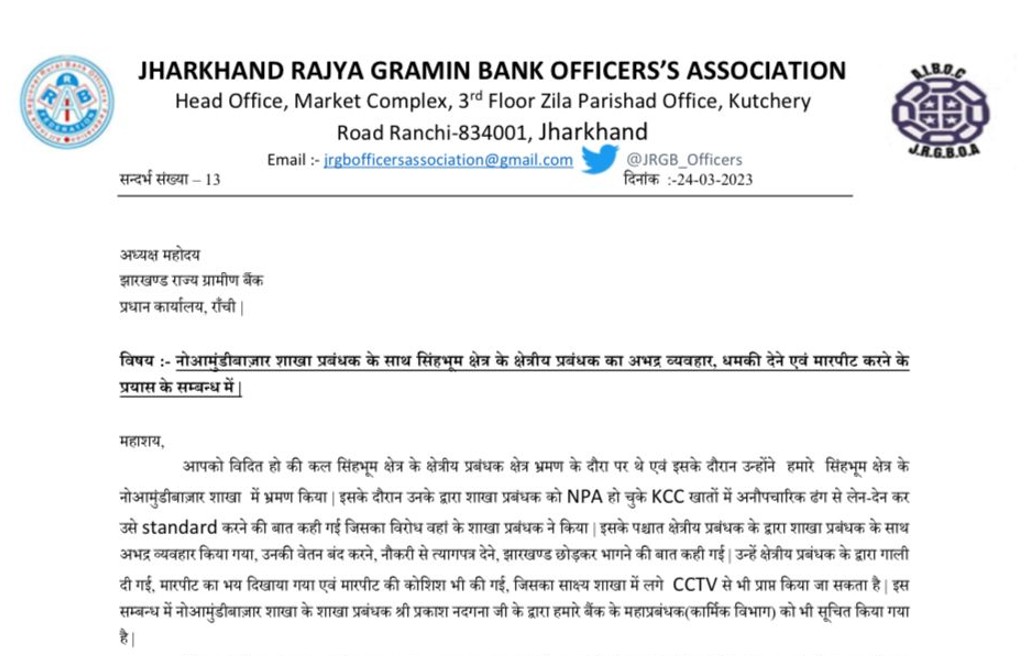

A March 2023 letter from the officers’ association of Jharkhand Rajya Gramin Bank to its president said that a regional manager ordered a branch head to forge documents to whitewash the NPA status of the branch’s KCC accounts. According to the letter, when the branch head refused, the regional manager threatened to stop his salary and lunged at him physically.

In an email statement, the bank told Article 14 that it had taken “appropriate action” and that “the complainant (officers’ association) was satisfied with the action taken by the bank and accordingly the matter has been closed.” The bank refused to share information on what became of the complaint.

A former branch head of Prathama UP Gramin Bank in Uttar Pradesh told Article 14 that the bank chairperson orally ordered branch heads at a meeting in 2021 to commit fraud to keep ineligible KCC accounts active.

The former branch head wrote an email to the chairperson, asking for this instruction in writing. When there was no reply, he filed a right to information (RTI) request with the bank in May 2023 and sought a response from the officer concerned to his email.

The bank told him that the organisation had not received the email in the first place. Article 14 has a copy of this email and the RTI reply.

In response to Article 14’s questions by email, the bank forwarded a letter it had sent to the ex-employee on a different matter. Article 14 requested the bank to comment on the matter at hand, but there was no response.

News reports from across the country substantiate these allegations of fraudulent disbursement of KCC loans. In March 2024, about 250 families in north-western Bihar’s Gopalganj district learnt their banks had issued KCC loans in the name of kin who were dead for years. The families found out when they received repayment notices and threats of penal action.

Similar cases were reported from Odisha and Uttar Pradesh in the last few months and from Andhra Pradesh and Telangana in recent years, in which investigating agencies including the Economic Offences Wing, the Central Bureau of Investigation and the Enforcement Directorate found branch managers and other officials siphoning hundreds of crores of rupees using fake documents related to KCC loans.

Bank employees shared another downside of the pressure to give KCC loans: many loan accounts are doomed to become NPAs and hurt the bank’s bottom line as borrowers refuse to repay in anticipation of loan waiver schemes. An increase in KCC NPAs has been a worry for banks (here and here).

In July 2023, this reporter received a video from rural Madhya Pradesh (MP) in which a KCC loan borrower told his bank’s loan recovery team that he would not pay up. His reason? The then chief minister Shivraj Singh Chouhan had supposedly assured people of a farm-loan waiver if his party were re-elected in state elections to be held later that year.

The bank employee who shared this video with Article 14 said he had himself received this reply from KCC borrowers. He cited the example of the prosperous village sarpanch (elected head), owner of a large house, car and tractor, who refused to repay a loan. Bank employees have regularly raised these issues on social media (here and here).

A bank employee said that another section of wilful defaulters exploited a one-time bank scheme that writes off NPAs if the borrowers made a mutually agreed-upon partial payment. In other words, borrowers got away with repaying only a part of the money they owed the bank.

This settlement scheme has worked as a recurring scam, said bank employees. A whistleblower complaint sent by employees of Punjab & Sind Bank (P&S Bank) in March or April 2024 to the RBI said: “Wide news has been spread among the public… to take KCC loan from P&S Bank and no need to pay it. Just pay six instalments, make it NPA and after two years, get it settled at 50% of the outstanding.”

The complaint letter said that branch heads charge such borrowers a “commission”, and that this commission is duly shared with senior executives.

The bank’s written response to Article 14 called these allegations “absolutely false and baseless”, adding: “Branches have very limited powers for KCC loans and loans above their power are sanctioned at back offices.” It said the bank has not received any specific complaint about KCC loans. (The aforementioned whistleblower complaint was marked to officials in the RBI, the finance ministry, the Supreme Court and a few media houses, not P&S Bank.)

Large-scale frauds have already been reported in the Centre’s other flagship financial inclusion schemes—low-cost life insurance, accident insurance and pension.

Article 14 and The Wire have reported how banks have been withdrawing money from customers’ accounts, without their permission, to enrol them in the Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana and Atal Pension Yojana.

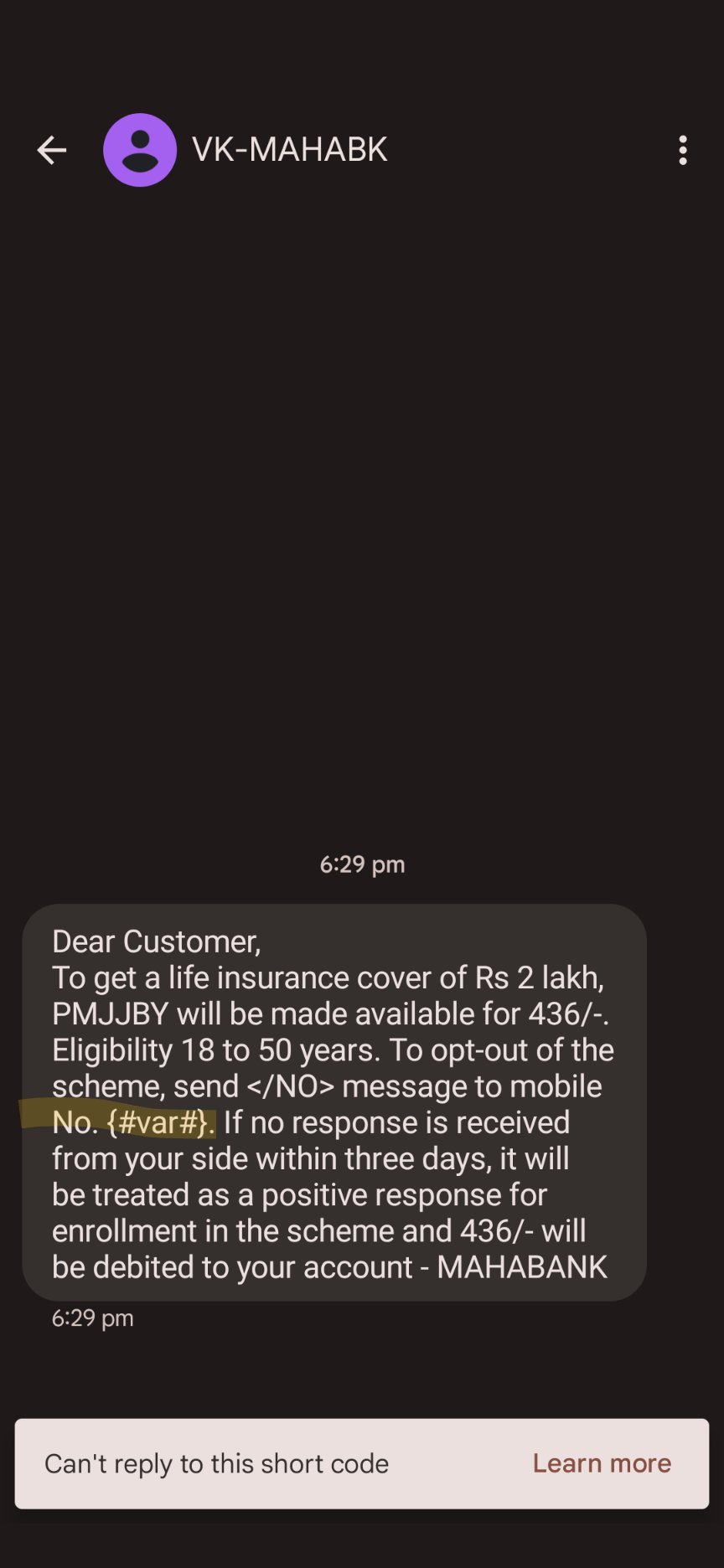

New evidence with Article 14 reveals another approach. Bank of Maharashtra has been sending text messages to customers, saying their accounts would be debited for these schemes unless they opt out within three days by sending a written request to their branch.

Some customers have posted on X that they got the option to opt out via a text message, but did not get the number to which they could send their opt-out request. One customer posted that he got such a text message a week after money was withdrawn from his account.

Bloated Bank Balance

Banks use smoke and mirrors not only for RBI’s initiatives and government schemes but also for their own business metrics. One such metric is the money they hold in savings and current accounts, their deposits.

The size of a bank’s deposits is a fundamental measure of its financial health and operational efficiency. A large deposit base tells the market that the bank is in good health and enjoys customers’ confidence, this perception potentially driving the bank’s stock price up.

Union leaders and employees of many banks alleged that with so much at stake, some banks fudge deposit figures at the end of every quarter of a financial year by transferring money from customer loan accounts to savings or current accounts, without authorisation, before reversing the sum later.

Some banks adopt a less risky approach; they request pliable customers to do this short-term money transfer as a help.

This practice hampers the RBI’s efforts to regulate cash flow, said experts, at times requiring the central bank to take remedial measures. It affects consumers by reducing the net credit banks can extend.

Forensic accountant Nikhil Parulkar, who has also worked in a bank, told Article 14 this practice was “prevalent everywhere”.

He said banks approach business customers with whom they have good ties. “Sometimes banks request them to keep money for a few days in their current and savings account and withdraw it after a few days,” he said. “Businesses agree to this, which results in confidence-building measures with the banks.” Parulkar called it a “standard practice”.

The RBI has been aware of this malpractice for decades and has been trying to keep it in check (here, here). In 2019, it penalised Indian Bank for inflating its deposits. In 2021, it issued master directions to banks to desist from indulging in this malpractice, which continues unabated.

Employees of P&S Bank say this malpractice was rampant in their organisation. The whistleblower complaint cited earlier accused the bank’s top management of 10 frauds, including artificially inflating its deposits in the January–March 2024 quarter.

An employee of the bank sent Article 14 a screenshot of his organisation’s WhatsApp group chat in which branch managers were “urged upon to achieve your allocated targets” on 30 March, a day before the financial quarter ended.

The employee said that this time the management asked to transfer money to inflate deposits with the cooperation of customers, whereas in the previous quarter, money was transferred without customers’ knowledge.

A little-known publication, Union Territory Independent News, reported in March 2024 how the bank committed this fraud in the October–December 2023 quarter.

The article, titled ‘P&S Bank Window Dressing Scam’, cited two internal emails in which the bank’s top management reportedly sent branches data of about 90,000 loan accounts, from which about Rs 5,000 crore were to be (illegally) transferred to savings and current accounts to artificially boost the bank’s deposits.

Responding to Article 14’s questions, the P&S Bank said this news article was “baseless and does not have any substance.” Assistant general manager (corporate communications) Sanjay Datta said the management never asked staff to adopt any unfair and unethical means to increase business.

That inflating deposits is a common practice is apparent from a confidential letter that Indian Bank sent to all its branch managers in March 2024. Bearing the subject line “Artificial increase in business figures near quarter ending dates”, the letter warned branch heads “not to resort to any deliberate, artificial increase in business numbers during quarter-end dates and immediate, subsequent reversal of the same in next quarter.”

One Canara Bank employee sent Article 14 screenshots of emails sent to him by his regional office in this regard.

Sent in September 2022, each email came with a list of loan accounts and asked the officer to “do the needful”. The officer said that the real instruction—to transfer the sum from loan accounts to savings accounts—came on a phone call.

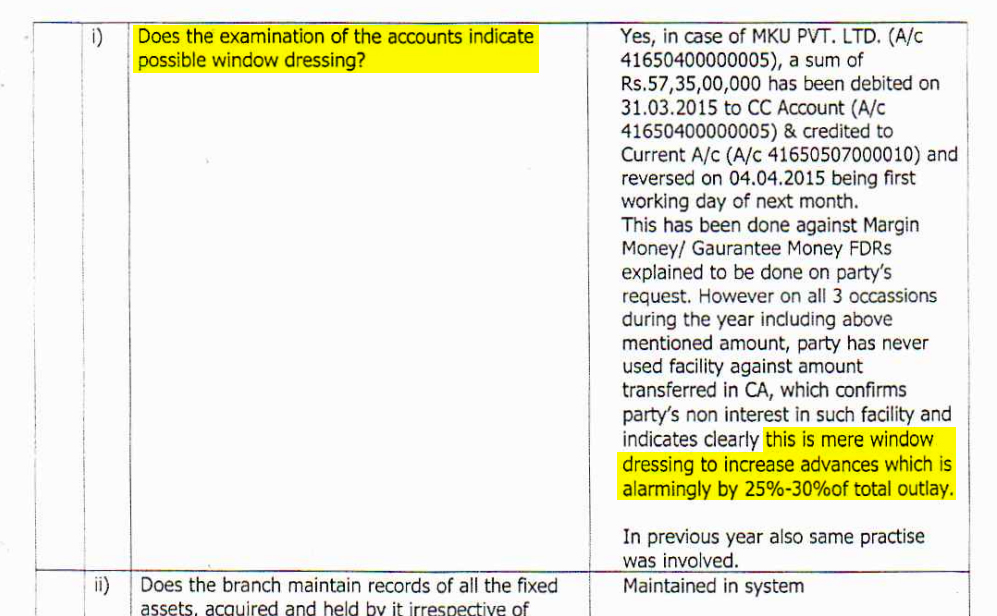

Also, Article 14 has seen evidence that Bank of Baroda’s Kanpur region illegally moved a sum of Rs 57.35 crore before and after two quarter-ends in 2014 and 2015.

This evidence includes a statutory audit report from 2016, a letter from the bank's chief vigilance officer stating that the allegations appeared to be true and a letter from the zonal internal audit division of the bank calling for an examination of the matter. Article 14 also looked at an account statement showing a credit and debit of Rs 57.35 crore on 31 March and 1 April respectively.

Multiple audit reports flagged these transactions.

Banks inflate not only their deposits at the end of a quarter, but also other data points. An employee of State Bank of India sent Article 14 screenshots of an email dated 30 March 2024 from his regional manager, instructing that certain savings accounts be converted to zero-balance accounts. The employee said that about 100 normal savings accounts in his branch were thus downgraded without customers’ knowledge to boost the number of zero-balance accounts the bank serves.

None of these banks replied to Article 14’s request for comments.

Fake Nominees, Real Losses

The union finance ministry informed Parliament in December that more than Rs 42,000 crore lie as unclaimed deposits in the country’s banks. The sum in bank accounts that have not been used for 10 years is called unclaimed deposit and is transferred to the RBI.

In February 2023, about Rs 35,000 crore in unclaimed deposits were transferred to the central bank.

To tackle the problem of unclaimed deposits because of the absence of a nominee for a deceased account-holder, the union finance ministry and the RBI have pushed banks to ensure that all accounts have nominees.

To circumvent this time-consuming effort, some banks entered bogus details in all such accounts. using a ‘bulk upload’. This hack allows banks to add the same particulars to all accounts with just a few clicks.

Dummy details entered as nominees compound the struggle for account-holders’ legal heirs.

A Canara Bank employee told Article 14 that he himself had to add fake nominees to about 8,000 accounts of his branch a couple of years ago using the bulk upload technique. He shared a screenshot of an email sent to him by his regional office in this regard. The email came with an attachment (the bulk upload file) and instructions on how to execute the bulk upload. Article 14 has seen the attachment.

The employee said his regional office told him that 8,000 accounts’ details had to be updated. The bank was in a rush to complete the task before an RBI-mandated deadline. He said the regional office advised him to enter “N/A” (Not Applicable) as the nominee name. Canara Bank did not reply to Article 14’s questions about the matter.

A now-deleted user account on X posted in November 2023 that rural branches were adding bogus nominees to hundreds of dormant accounts. Over chat, the user, who said he is a bank employee, informed this reporter that this was happening via bulk upload in one of the largest government banks in rural Uttar Pradesh.

Noted economist Jayati Ghosh expressed shock at these malpractices. “We have seen many such instances of suppression, manipulation or even false creation of data by employees in different public institutions working under severe political pressure,” she said in an email interview.

Rather than blame the banks, Ghosh said, the culture and the “subservient attitude” of their management was notable.

“Remember the fake Jan Dhan accounts? This is because the aim of the current government is to control the narrative and to enhance its public relations, not to govern in the interests of the people,” she said, calling it “doubly tragic” that while citizens do not get to know what was happening, the government was not confronted by problems or the real outcomes of its policies.

“In fact, we have policymakers shooting in the dark,” said Ghosh, “And citizens being fooled and befuddled.”

(Hemant Gairola is an independent journalist based in Dehradun.)

Get exclusive access to new databases, expert analyses, weekly newsletters, book excerpts and new ideas on democracy, law and society in India. Subscribe to Article 14.